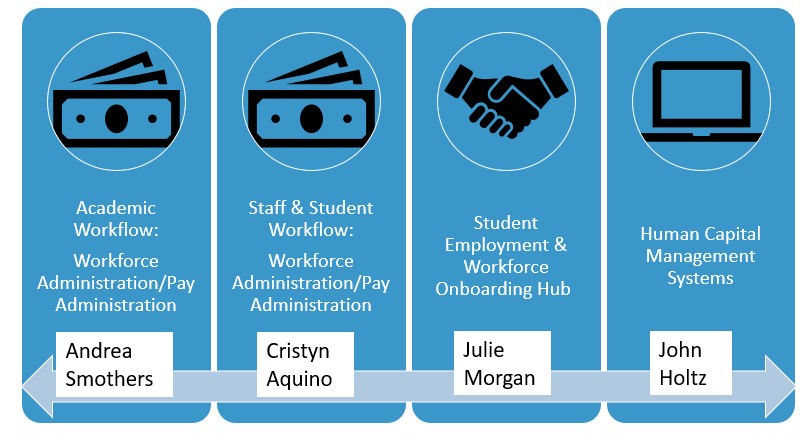

What We Do

Payroll Inquiries: https://bfs.ucmerced.edu/form/payroll-services-inquiry

* We are currently experiencing High Volume of inquiries. Anticipated response times maybe longer than normal. Please be patient as the team works through the inquiries received.*

Payroll: Job Aids

Human Resources Systemwide Notice :Timesheets Policy Reminder

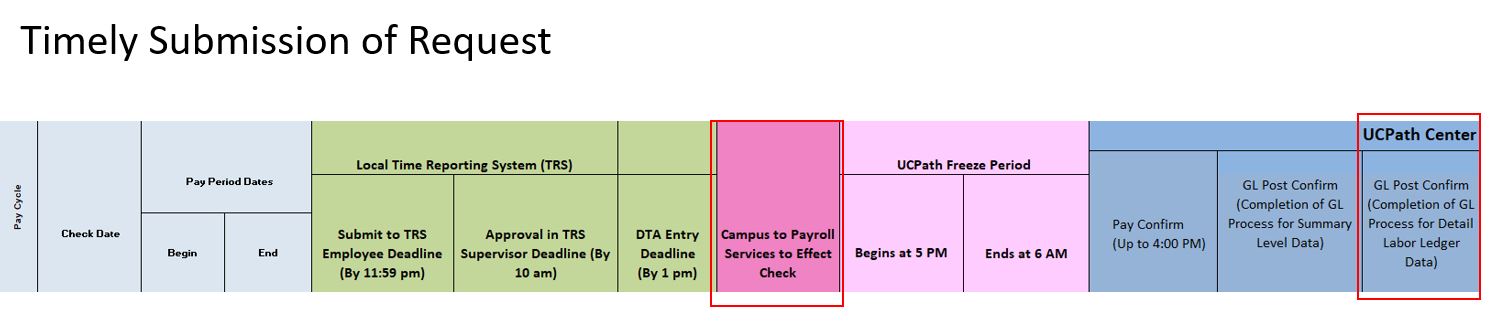

Where to Find the Deadlines: https://bfs.ucmerced.edu/our-services/payroll-services/deadlines-calendars

Dates to Note:

- Deadline to send Transaction Request to Payroll Services – Must Be received by date to allow for processing

- GL Post Confirm- Date UCPATH will send information to campus GL Systems (Oracle)

Top Reasons for Impacts to Transactions:

- Timely Submission fo Request

- Accuracy and Completeness of Request

Announcements

Payroll Services Website URL Change Effective 08/28/25

Effective Thursday, August 28, 2025 the Payroll Services website URL is changing. The new URL will be payroll.ucmerced.edu. This will provide campus an easy to find and dedicated Payroll Services site.

What you need to know:

• Bookmark the new site on 08/28/25

• Bookmark your favorite Payroll Services on 08/28/25

• Report any issues by submitting a UC Merced ServiceNow ticket

Protect yourself- UCPATH Direct Deposit

Read more here:

Updated Information:

NEW- Payroll Roles and Responsibilities Matrix

NEW- Job Aid - Completing and Submitting an SCT_BCT Request

- Summer Salary

- Summer Salary Escalation Process

- BX/BR Appointments

- Payroll Advisory on SCT/Direct Retro

- Advisory: UCPath DCP and FICA Adjustments

- Expanded Sick Leave-UCNET

- Local HR Website on Expanded Sick Leave Policy

- A New Look is coming to UCPath Portal