The Controller’s Office is providing this update regarding recent UCPath-initiated corrections to FICA and DCP Safe Harbor contributions. These adjustments address a system error that impacted employees transitioning from student to non-student status, resulting in missed Medicare deductions and retirement contributions.

What Departments Should Know About Upcoming Adjustments

-

UCPath adjustments to correct employer contributions related to previously identified FICA errors will automatically post to the General Ledger (i.e., department-level COA).

-

A second correcting entry will be processed by UC Merced’s Financial and Accounting Services team to reflect the employee portion of the FICA entry. Departments will be notified once all corrections have been posted.

For context, see the UCPath Center advisory below regarding DCP and FICA adjustments.

If your department has any questions, please contact Financial and Accounting Services at accounting@ucmerced.edu.

UCPATH Center- UCPATH DCP & FICA Adjustments

On July 23, 2024, UCPath informed locations of a system error that resulted in missed deductions of federally mandated payroll taxes when employees made the transition from student to non-student employment. These taxes, known as FICA (for the Federal Insurance Contributions Act), go toward future Social Security and Medicare benefits and appear on earning statements as FED OASDI and FED MED. Originally, UCPath identified all affected employees as impacted with missed deductions for both Social Security and Medicare. Further analysis identified a subset of the original FICA impacted group who pay only Medicare-related taxes; these employees do not pay into Social Security. In lieu of paying Social Security taxes, UC employees who are not otherwise covered by a retirement system contribute 7.5% of wages (pre-tax) to the UC Defined Contribution Plan as Safe Harbor (or DCP Safe Harbor). For this group, UC missed both the Medicare deductions and DCP Safe Harbor contributions until correcting the tax status error on active employees in August 2024.

UC accepts full responsibility for missed Medicare deductions and DCP Safe Harbor contributions. UC is repaying the federal government for both the employee’s and UC’s shares of unpaid Medicare taxes (1.45% of wages for each share). In addition, UC will cover 100% of the missed employee contributions to DCP Safe Harbor (7.5% of wages) from 2019 through 2024 and any lost financial gains from having those investments.

Imputed Income – Medicare Only:

The IRS considers the past Medicare taxes UC pays on the employees’ behalf as “imputed income,” which is taxable. Although UC originally indicated the imputed income would be reflected as taxable earnings on employee W-2s only, we now understand that they owe additional taxes on the imputed income. These taxes will be collected from active employees via an upcoming on-cycle paycheck. Inactive employees who owe taxes on imputed income will follow the standard overpayment recovery process.

DCP Safe Harbor:

The IRS does not consider the contributions UC will cover related to DCP Safe Harbor imputed income. Processing to determine missed DCP Safe Harbor contributions will occur between February and June of 2025. UC will deposit these contributions into each recipient’s DCP account maintained by Fidelity; if a recipient does not have an active DCP account, an account will be opened for them. UC recognizes that employees may have missed potential financial gains from not having these contributions invested for the full duration. As such, Fidelity will complete an investment gain/loss analysis, and UC will make appropriate adjustments, including contributions of lost earnings to the DCP accounts.

UCPath will inform impacted employees of the DCP Safe Harbor missed contributions, the corrective action UC is taking and the tax impacts related to imputed income UC pays on the employee’s behalf.

Adjustments Processing Schedule:

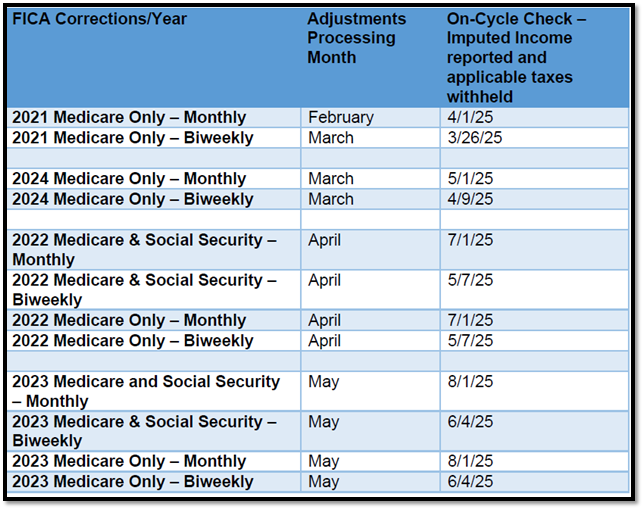

UCPath completed adjustments in October and November 2024 for employees who had Social Security and Medicare impacts for years 2021 and 2024. Adjustments for the remaining periods — 2022 and 2023 for Social Security and Medicare, and 2021 through 2024 for Medicare-only — will be processed as follows:

UCPath expects to process adjustments to determine the DCP Safe Harbor missed contributions from 2019-2020 later this year. Since DCP Safe Harbor contributions are not considered imputed income, there are no impacts to on-cycle checks or overpayments.

What Employees Should Know:

Employees will receive corrected W-2 (W-2c) forms for prior years showing the adjusted FICA wages and FICA taxes paid by UC. Corrected W-2 forms for prior years are for reference only. This error did not affect federal and state taxable earnings for 2021-2023, and employees do not need to refile taxes for any prior year.

If employees have any questions after reading the information above, please do not hesitate to contact UCPath by logging in to UCPath and selecting Ask UCPath to submit an inquiry. Employees may also call UCPath to speak with an associate at (855) 982‐7284 from 8:00 a.m. to 5:00 p.m. (PT) Monday through Friday.