Honorarium Quick Links

- What is an Honorarium

- Quick Facts

- Who is Eligible

- How to Request an Honorarium | 1 page overview

- Policies and Resources

- FAQs

What is an Honorarium?

An honorarium is a payment made to an individual as a token of appreciation for services rendered, where propriety precludes setting a fixed price. At UC Merced, honorariums are typically used for:

- Guest speaker.

- A special lecture, short series of special lectures.

- Conduct seminars or workshops of no more than 2 weeks.

- Musical demonstration related to Music Department instruction.

- Appraisal of a manuscript for the University Press or an article submitted to a professional publication.

Honorariums are not intended for ongoing services or employment-related work.

Quick Facts

- Annual Limit: $2,500 per individual per calendar year

- IRS Reporting: Required for payments of $600 or more

- Non-Resident Tax: 7% withholding for non-residents if payment exceeds $1,500

- UC Employees: Must be submitted through the Academic Personnel Office.

- Non-Employees: Processed via Accounts Payable using a Non-PO Payment Request

- Visa Restrictions: Certain visa types (e.g., H-1B) are not eligible for honorarium payments. Refer to the Visa Classification Chart for a list of eligible visa types and documentation requirements.

- Funding Restrictions: Generally, honorarium payments are not allowed to be made with federal funds unless a contract or grant specifically authorizes such payments. State funds may be used to pay honoraria to individuals not employed by the University (e.g., outside speakers).

- Authorization to Approve:

- Non-grant Funds: Only an individual with the delegated authority listed on the Chief Administrative Officer (CAO) list may approve the payment request form.

- Grant Funds: Research Administrators (RA).

Who is Eligible?

- Non-UC employees (processed through Accounts Payable)

- UC employees (processed through Academic Personnel)

Note: Hononoraria are not for UC employees, independent contractors, or consultants performing work that requires a contract. H-1B visa holders are not permitted to receive honorarium payments.

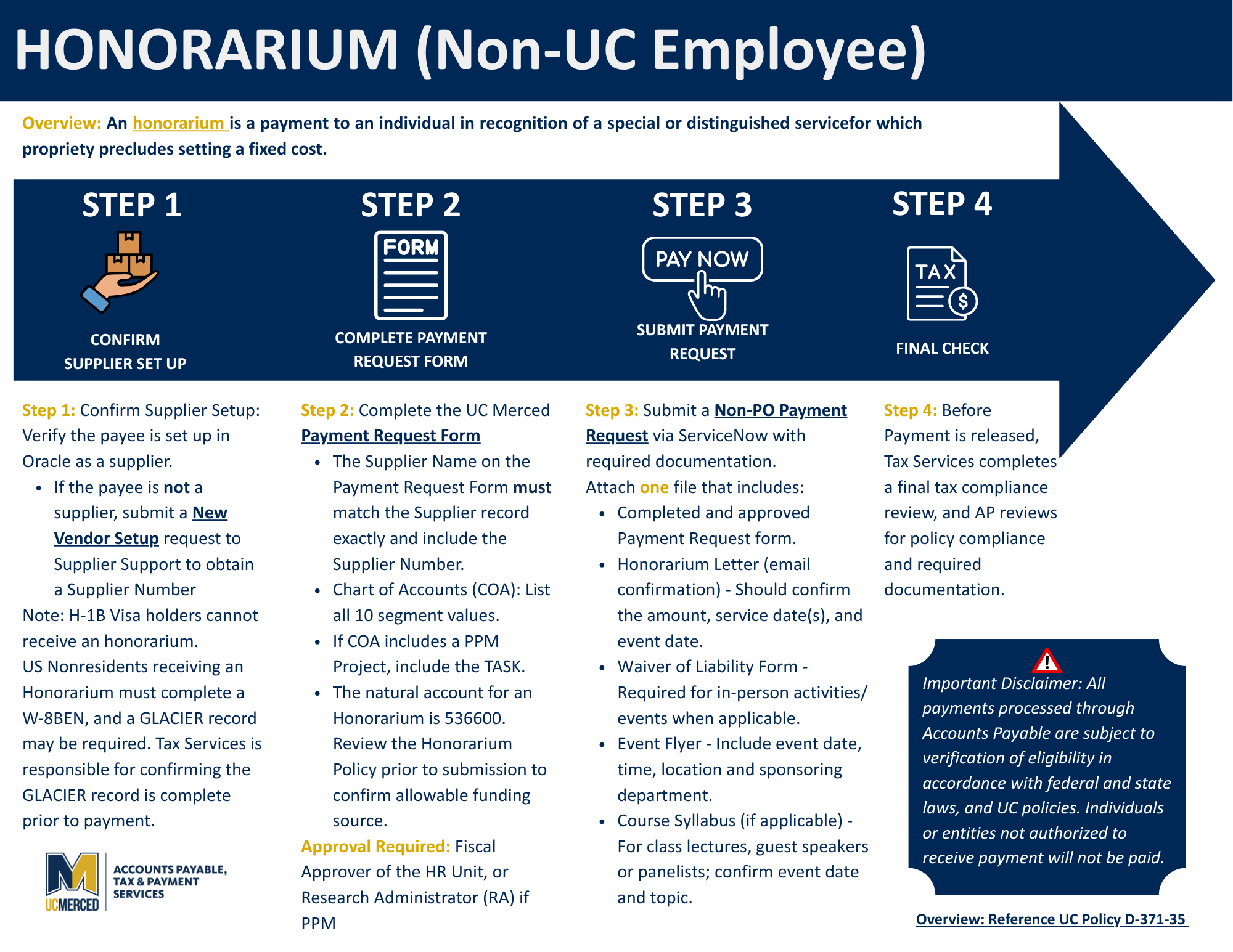

How to Request an Honorarium

Before You Begin

☐ Confirm the payment qualifies as an honorarium:

- It is a one-time payment given as a thank you for services provided.

- It is for a guest lecturer, speaker, or panelist providing short-term service.

- It is not for UC employees, independent contractors, or consultants performing work that requires a contract.

- H-1B visa holders are not permitted to receive honorarium payments.

Important Disclaimer: All payments processed through Accounts Payable are subject to verification of eligibility in accordance with federal and state laws, and UC policies. Individuals or entities not authorized to receive payment will not be paid

Step 1: Confirm Supplier Setup

☐ Verify the payee is set up in Oracle as a supplier.

☐ If the payee is not a supplier, submit a Vendor Setup ticket to Supplier Support to obtain a Supplier Number.

Step 2: Complete the Payment Request Form

☐ Complete the UC Merced Payment Request Form.

☐ Ensure the name on the Payment Request Form matches the Supplier Profile and includes the Supplier Number.

☐ Chart of Accounts (COA): List all 10 segment values. If a PPM project exists, include the Task.

☐ Approvals:

- Fiscal Approver (for HR Unit), or

- Research Administrator (RA) if PPM project.

Step 3: Submit Your Payment Request and Required Documentation

☐ Submit a Non-PO Payment Request via ServiceNow.

☐ Attach one file that includes:

- Completed and approved Payment Request form.

- Honorarium Letter (email confirmation) – Should confirm the amount, service date(s), and event date.

- Waiver of Liability Form – Required for in-person activities/events, when applicable.

- Event Flyer – Include event date, time, location, and sponsoring department.

- Course Syllabus (if applicable) – For class lectures, guest speakers, or panelists; confirm event date and topic.

Step 4: Tax Review

☐ Honorarium payments require a final tax review by Tax Services.

Policies & Resources

- UC Policy D-371-35: Disbursements - Honorarium Payments

- APM-666 Honoraria Paid to UC Employees

FAQs

Q: Can I pay an honorarium for virtual events?

Yes, as long as the service qualifies under UC policy.

Q: What if the recipient is a foreign national?

Check visa eligibility and apply tax withholding rules.

Q: Can I split an honorarium into multiple payments?

No, honorariums must be processed as a single payment.